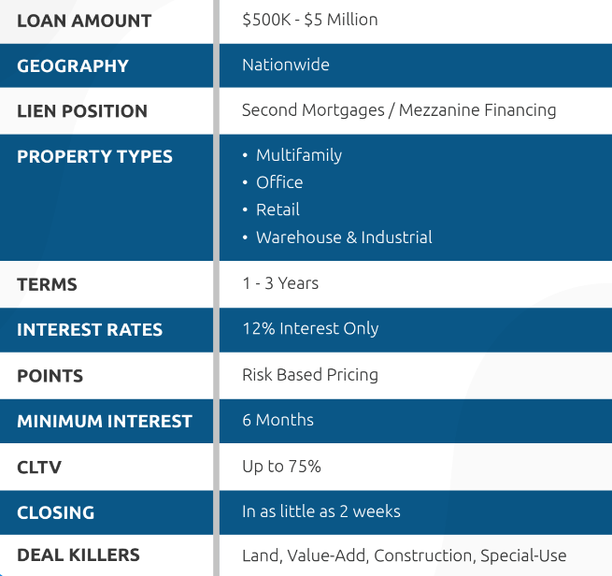

Get $500,000 to $5,000,000 in Equity Funding

Get a Second mortgage loan without refinancing your property.

Get Real Estate, Fix and Flip or Buy & Hold Investment Property.

|

Who is your typical borrower?

Our borrowers are experienced and sophisticated commercial real estate investors. They are asset rich but temporarily liquidity poor, with the need to quickly access capital in order to take advantage of a time-sensitive situation. Does my property have to be income producing? While we will entertain minor value-add projects on a case-by-case basis, we have a strong preference for completely stabilized and cash-flowing properties with historically strong occupancy. Under no circumstances will we lend on any land, construction, special-use, or owner-occupied properties. What if my first mortgage prohibits subordinated debt? We offer different types of subordinated debt in order to provide flexibility in structuring deals that are in full compliance with your loan. It is possible your loan prohibits a second mortgage, but allows mezzanine financing or a preferred equity investment. We have successfully completed deals behind private lenders, traditional banks, CMBS, Fannie Mae, and Freddie Mac loans. |

Immediate LiquidityRefinancing your first mortgage can take months but with our financing you can receive cash in as little as two weeks.

|

No Prepayment PenaltiesWho wants to pay hefty prepayment penalties such as defeasance and yield maintenance to their lender?

|

Keep Your Interest RateRateRefinancing into a new first mortgage could leave you with a higher interest rate and larger monthly payments.

|

Three simple steps to unlock your equity

|

|